Fellow 10X’er…

A lot of people say the American dream is to own your own home – free and clear.

I call BS.

To prove my point, let’s look at the highest rental rates in the country – a place where people say you’d be crazy to rent if you could afford to buy instead.

And that’s Manhattan.

In July – for the second month in a row – the average rent in Manhattan was over $5,000.

Just a year ago, it was $4,000.

When a lot of people see these stats, they say…

“I’d never pay rent like that – it’s throwing money away!”

Well, let’s do some quick math. Don’t worry, I’ll keep it simple.

If you signed a lease in Manhattan today, you’d be paying – on average – around $60,000 a year.

What about buying?

The average home in Manhattan in July was $1.3 million.

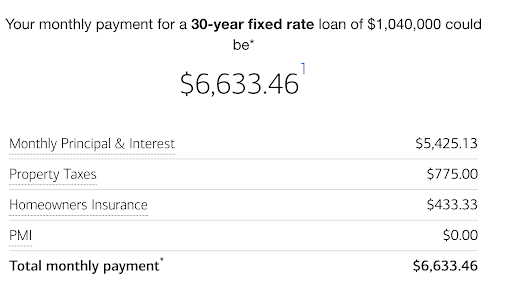

If you put 5% down and took out a 30-year loan, here’s what your payments would be…

Let’s call it $80,000 a year.

Which doesn’t include condo fees, repairs, or anything like that.

So, renting in Manhattan will save you at least $20K a year versus buying.

Here’s when the “own the home you live in” crowd gets smug…

They’ll tell you “well, in 30 years, I’ll own my home free and clear… you don’t get that with renting!”

Not so fast…

Yes, you will own the home free and clear.

But what if you invested the money you saved when renting instead?

First, there’s the 5% you would have had to put down if you bought.

That’s $65K.

Now, add that to the $20K you saved in year 1 alone… and you have saved $85K.

That $85K can be used as a 20% downpayment on a cash-flowing property in a cheaper part of the country.

And if you buy in the right area, your tenants will pay the rest of the mortgage for you.

Now, if you keep on investing that $20K difference between renting and owning…

You’d have $665K invested over 10 years.

With that, you could own probably 10 houses… and again, the tenants will pay for them for you.

Now, you’re getting equity and cash flow off 10 houses.

So, tell me, which is better in the long run –

renting or owning?

Obviously renting.

But I hear what you might be thinking…

“Grant – I don’t want to be a landlord!”

Well, you don’t have to.

You could either…

- Pool that $665K in savings with other investors and buy multifamily

property – putting professional management in place. You’ll never have to deal with tenants. And you’ll make a fortune in the long run. - Invest in multifamily properties passively – and potentially earn returns of 15% a year.

After 30 years of only investing the savings from renting, you’d be earning $99,750 in passive income every year.

The truth? Renting your primary residence – not owning it – can make you rich.

Grab my free book, How to Create Wealth Investing in Real Estate to get started.

Keeping it real,

– Grant