Fellow 10X’er…

I just saw an article that made the following claim…

“Nearly half of U.S. mortgage payers own at least 50 percent equity.”

And by that, they mean…

Half of all homeowners owe less than half what their houses are worth.

This all sounds great on paper…

More equity in American homes means more wealth for the average American, right?

Not so fast…

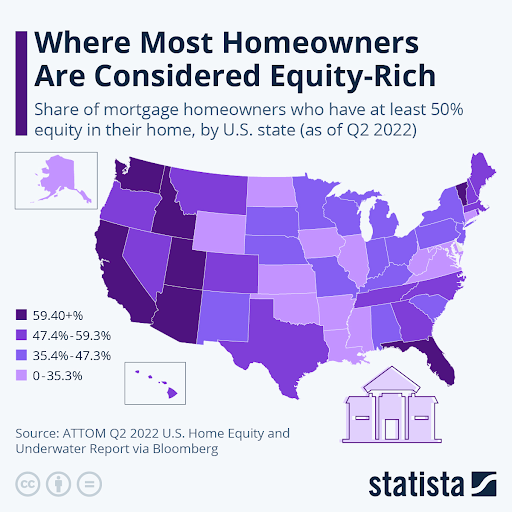

Here’s how they break it down by state…

The darker purple states are the ones with the most “equity”.

And the fact that California and Florida are 2 of the states with the highest equity reveals the problem.

Americans aren’t building equity because they’re paying down their homes faster… they’re building equity because home values have shot up since the pandemic.

The median home price in America has increased by nearly 33% over the last 2 years.

So, all this new equity is really just luck.

And if the single-family home market corrects… like it’s already started to…

That phantom wealth is going to disappear faster than a bowl of crawfish at a Louisiana boil.

I keep banging the drum…

The home you live in is NOT an investment.

What happens if you borrow against that phantom equity – and it disappears?

You’re left holding the bag – making payments on a house you’re upside down on.

And if you need to sell in a hurry? Good luck. It won’t happen. And at best you’ll just walk away.

If you’re looking to build real equity, cashflow, and generational wealth… stick to multifamily.

And if you’re mortgage-free, consider taking some of that equity and leveraging it to buy 32 doors, instead of just one.

Keeping it real,

– Grant